WE ARE COMMITTED TO ADDRESSING THE INTERCONNECTED ISSUES OF CHILD ABUSE, DOMESTIC VIOLENCE AND HOMELESSNESS

Once a survivor of domestic violence escapes, they likely experience homelessness, and children who grow up in homes of violence often carry that trauma with them throughout the rest of their lives. These situations have devastating effects on individuals and families in our community.

Family Tree works alongside people affected by child abuse, domestic violence and homelessness throughout their journey to safety and economic independence, providing emergency residential services, case management and advocacy, therapeutic services, outreach support, housing search and placement, education and employment support, among many other services. By leveraging a deeper, broader and more holistic array of life-changing services and programs, Family Tree empowers individuals and families to discover their own strengths to create lasting, positive change.

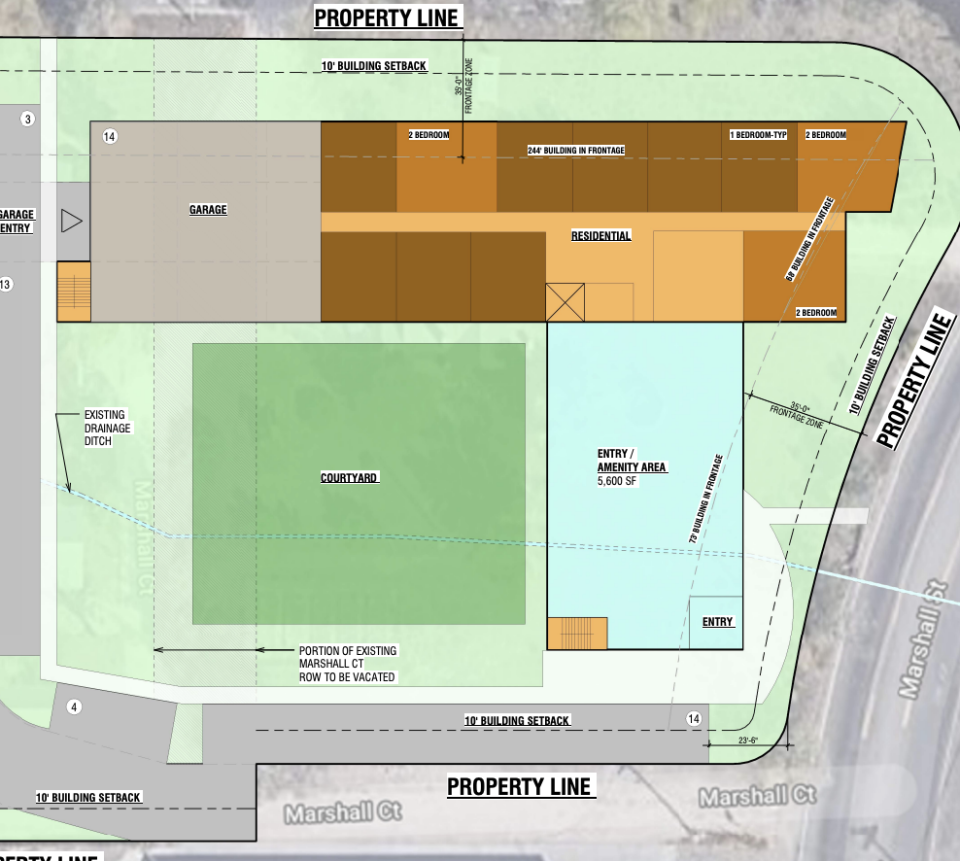

Marshall Street Landing

Family Tree believes everyone needs a safe place to call home. We have been successfully supporting people at-risk of or experiencing homelessness for over 30 years. As we continue expanding our services throughout the Denver Metro area, we are excited to share updates and announcements on our most recently proposed development on our property at 5549 Marshall Street.

of youth who engaged with Family Tree Community Family Resource Team last year were diverted from further child welfare system involvement

of households exiting our Homelessness Program moved into safe and stable housing last year

A Story of Resilience

Michelle grew up in what she described as a dysfunctional family. She was living below the poverty line, her mother was a drug addict, and her father was absent. As a teenager, Michelle knew she needed to leave, but when she did, she found herself in an abusive relationship. Over many years, Michelle and her two young children, tried to escape countless times but always ran out of resources, leading them back to her perpetrator. This cycle finally ended when Michelle found Family Tree.